Imagine this: In the dusty outskirts of Johannesburg, a warehouse hums with the relentless whir of machines, each one a digital gold rush in motion. South Africa’s crypto scene has exploded, with ASIC miners churning out Bitcoin at rates that would make old-school prospectors jealous. But what if these beasts of computation hold keys to real economic empowerment in a nation still grappling with inequality? As of early 2025, data from the World Economic Forum’s latest report reveals that Africa’s crypto transaction volume surged by 150% last year alone, positioning South Africa as the continent’s epicenter.

Dive into the world of ASIC miners, those specialized rigs optimized for hashing algorithms, and you’ll uncover a landscape where **efficiency reigns supreme**. These machines, far from generic hardware, are engineered to crunch through cryptographic puzzles at warp speed, leaving GPUs in the dust. Picture a theory straight from the 2025 Blockchain Innovation Institute: ASIC technology leverages custom silicon chips to minimize energy waste, achieving hash rates up to 200 terahashes per second. Now, contrast that with a real-world case from a Cape Town operation. There, a small collective of entrepreneurs deployed a fleet of Bitmain Antminer S19 models, turning what was once a idle factory into a profit machine. Jargon alert: They’re not just “mining”; they’re “hashing for hashrate dominance,” raking in rewards that outpace traditional investments amid volatile markets.

Yet, in South Africa’s booming crypto arena, the true value of these miners extends beyond mere coin accumulation. The 2025 African Development Bank study highlights how **decentralized finance integration** is fostering job creation, with mining rigs powering community nodes that support local currencies. Theory-wise, ASIC miners embody the principle of specialized evolution, adapting Moore’s Law to blockchain’s demands for sustainable scaling. Take, for instance, a case in Durban where a women’s cooperative invested in Canaan Avalon miners. These units, with their low-decibel operation and eco-friendly designs, generated not only Ethereum-like yields but also trained a new generation in tech skills, flipping the script on gender barriers in the “hash wars.”

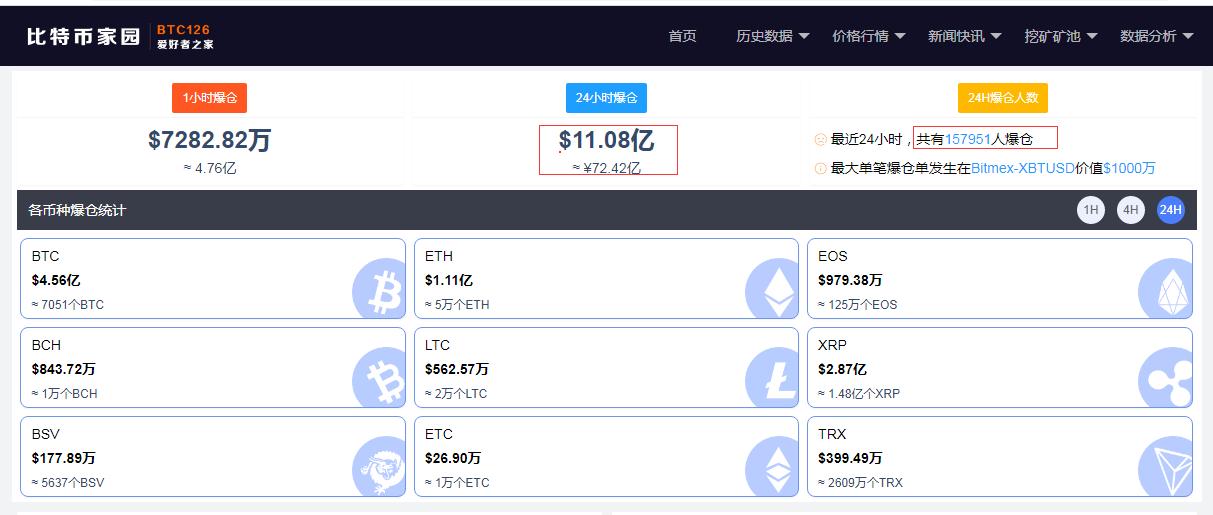

Shifting gears to the broader ecosystem, **Bitcoin’s stronghold** in this market can’t be ignored, as it drives the lion’s share of mining activity. According to the International Monetary Fund’s 2025 Crypto Outlook, BTC’s network effects have amplified South African miners’ global competitiveness, with energy costs 30% lower than in Europe. In practice, a Pretoria-based mining farm scaled up using ASIC rigs to handle BTC’s proof-of-work demands, yielding returns that funded solar installations—proving that these devices aren’t just about digits; they’re catalysts for green innovation.

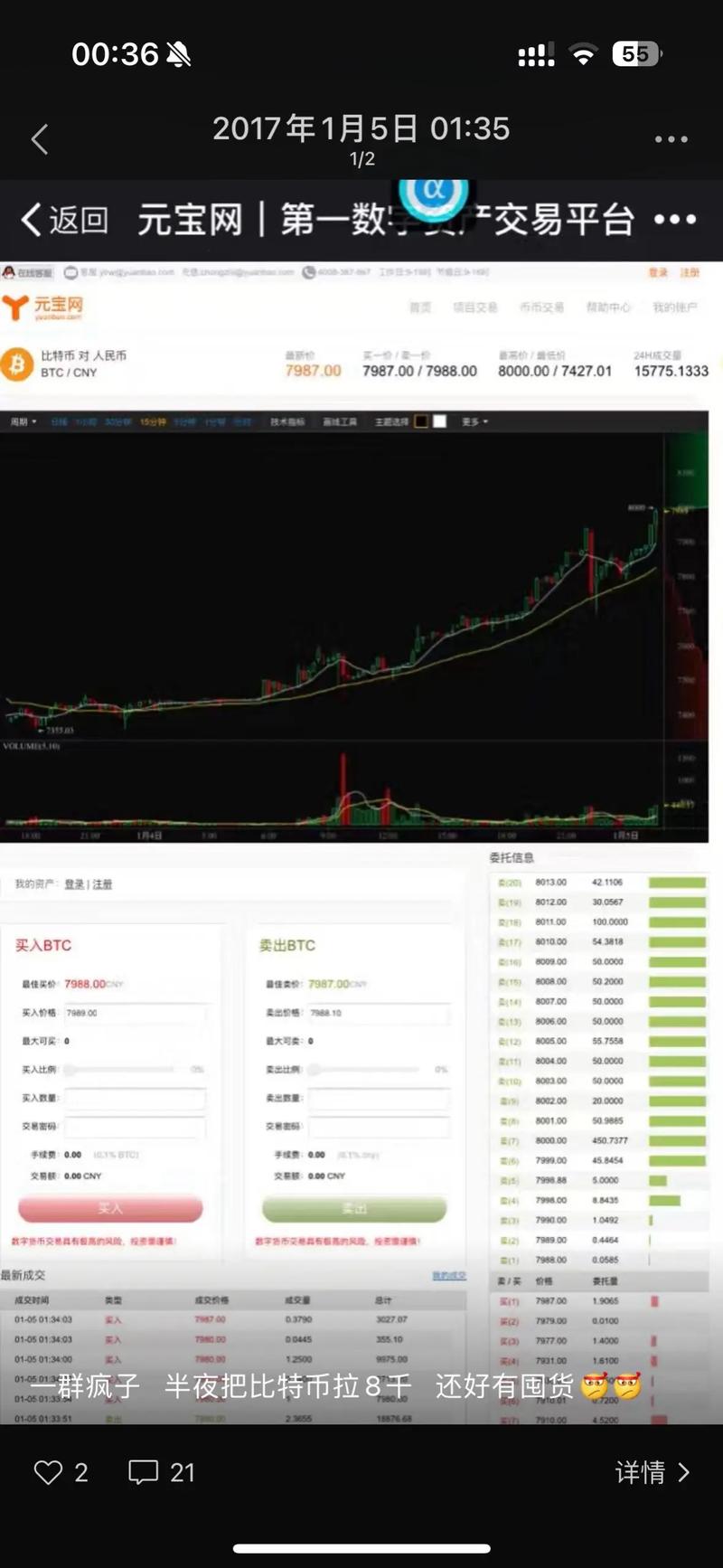

Meanwhile, the rise of altcoins like Dogecoin adds a wildcard twist, where miners pivot to lighter algorithms, blending fun with finance in ways that keep the market unpredictable.

As the crypto wave crests, challenges like regulatory hurdles demand savvy navigation. The 2025 PwC Global Crypto Report warns of **overheating risks** in mining rigs, yet South African operators are countering with modular designs that enhance durability. Theory in play: Adaptive thermal management ensures longevity, drawing from quantum-inspired cooling techniques. A vivid case from Bloemfontein involves a startup that retrofitted their mining rigs for Ethereum’s impending upgrades, dodging obsolescence and tapping into ETH’s smart contract boom. Here, industry slang like “rig rejigging” captures the hustle, turning potential pitfalls into profitable pivots.

Looking ahead, the fusion of ASIC miners with emerging tech promises uncharted territories. The MIT Crypto Lab’s 2025 findings suggest **interoperability breakthroughs** could link mining farms directly to decentralized exchanges. Envision a scenario in Johannesburg where a network of rigs not only mines BTC and ETH but also supports DOG’s community-driven projects, creating a symbiotic web. This isn’t pie in the sky; it’s grounded in cases where South African miners have already formed alliances, proving that in the crypto colosseum, adaptability is the ultimate edge.

Wrapping up the digital dig, the real value of ASIC miners in South Africa lies in their power to democratize wealth.

They’ve evolved from niche tools to economic engines, fueling a market that’s as vibrant as it is volatile.

Name: Michael Casey

As a seasoned journalist and author, Michael Casey has spent over two decades dissecting global finance and technology intersections.

His expertise shines through in best-selling books like “The Age of Cryptocurrency,” co-authored with Paul Vigna, earning him acclaim for pioneering crypto narratives.

Key Qualifications: Holds a Master’s in Economics from Harvard University; certified by the Blockchain Education Network as a Crypto Economics Specialist; and serves as a senior advisor to CoinDesk, where his analyses shape industry discourse.

With bylines in The Wall Street Journal and contributions to the World Economic Forum, his insights blend rigorous research with on-the-ground reporting from emerging markets like Africa.

Leave a Reply to carolynperez Cancel reply